TORONTO, April 15, 2020 – Arizona Metals Corp. (TSX.V:AMC) (the “Company” or “Arizona Metals”) is pleased to announce assay results of the first seven drill holes completed at its Kay Mine Project, located near Black Canyon City, Arizona.

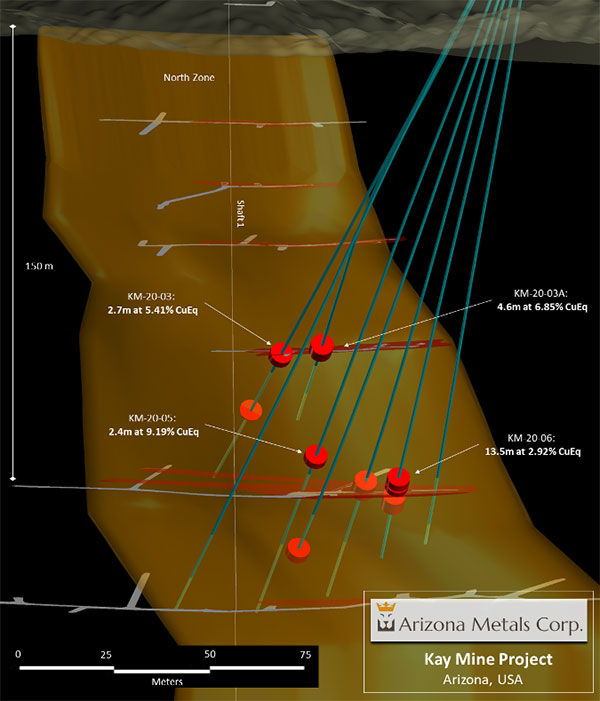

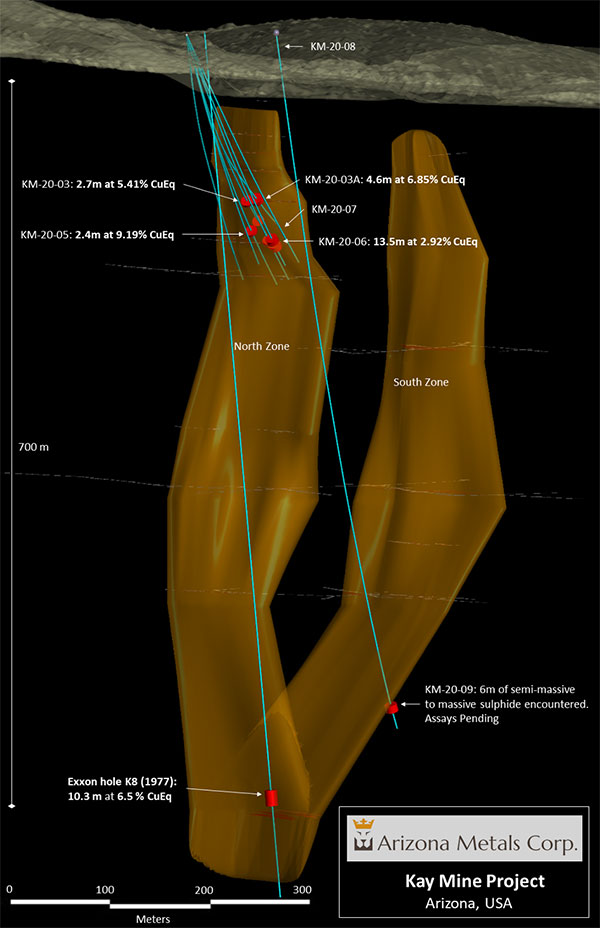

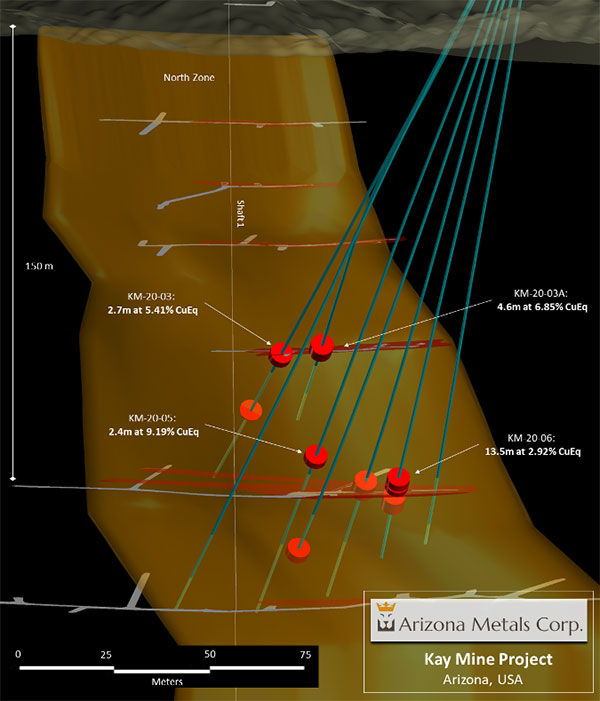

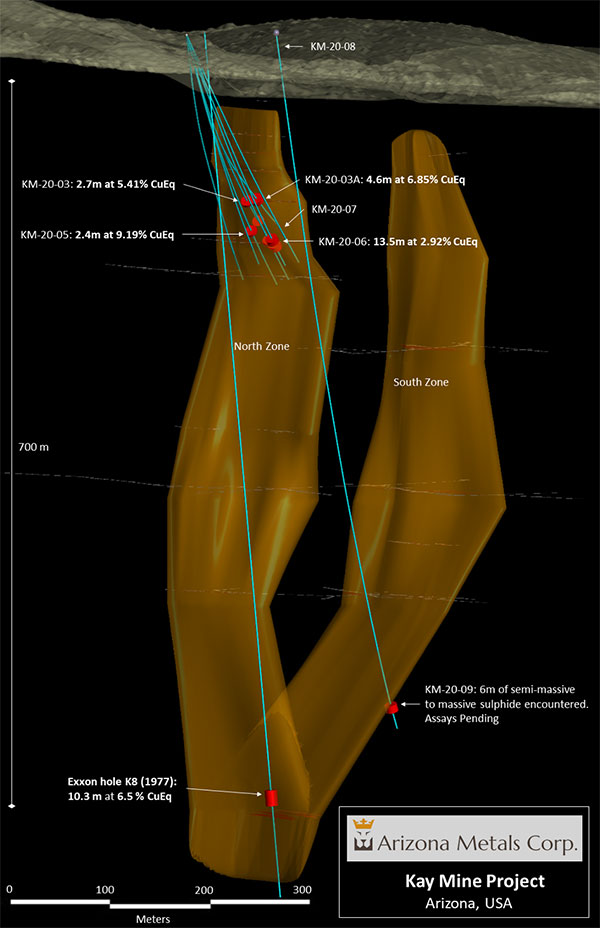

The first seven holes of the drill program, KM-20-01 to KM-20-07, were drilled to test the shallowest part of the North Zone which starts at a vertical depth of approximately 100m (Figure 1). Holes KM-20-01 through KM-20-06 all intersected massive sulphide mineralization (Table 1). Hole KM-20-07 did not intersect significant mineralization and is believed to have passed between the North and South Zones.

Arizona Metals’ drilling tested a vertical extent of approximately 50m in the North Zone, to a vertical depth between 120-170m. Historic underground exploration by Exxon Minerals reported mineralization at depths in the North Zone of up to 300m below recent drilling by Arizona Metals.

An additional two holes, KM-20-08 and KM-20-09, were drilled in March 2020 to test the South Zone (Figure 2). Hole KM-20-08 suffered significant deviation and was stopped and grouted after 36m of progress. Hole KM-20-09 was then aimed at the same target at depth and intersected approximately six metres of semi-massive to massive sulphide mineralization, at a vertical depth of 570m. Assays are pending. This intersection is approximately 160m vertically above hole

KM-8, drilled by Exxon Minerals in 1977, which returned a true width intersection of 10.3m at a grade of 6.5% CuEq. Exxon Minerals also reported significant historic intersections located approximately 150m vertically above hole KM-20-09 in the South Zone. Arizona Metals Corp. is targeting additional exploration holes to test above and below hole KM-20-09.

Highlights of the first six holes in the North Zone include:

KM-20-03: 2.7m grading 5.41% CuEq (incl. 0.9m of 10.32% CuEq), from a depth of 120m

KM-20-03A: 4.6m grading 6.85% CuEq (incl. 0.8m of 18.19% CuEq) from a depth of 122m

KM-20-05: 2.4m grading 9.19% CuEq (incl. 1.2m of 13.89% CuEq) from a depth of 150m

KM-20-06: 13.5m grading 2.92% CuEq (incl. 4.9m of 4.54% CuEq) from a depth of 158m

The massive sulphides consist of primary copper mineralization in chalcopyrite, with lesser amounts of zinc in sphalerite (Figures 3 and 4). Marc Pais, CEO, commented “We are very encouraged to see that the initial holes of the Phase 1 program have encountered grades, widths and mineralization very similar to those reported by previous operators. We are especially pleased to see the proportion of gold and silver content in the assays reported. To date we have tested only the shallowest part of the North Zone and one portion of the South Zone. We look forward to continued testing of the extents of mineralization on strike and at depth, as soon as it is safe to resume drilling.”

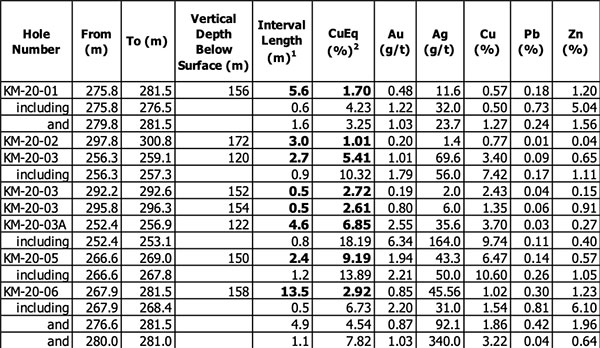

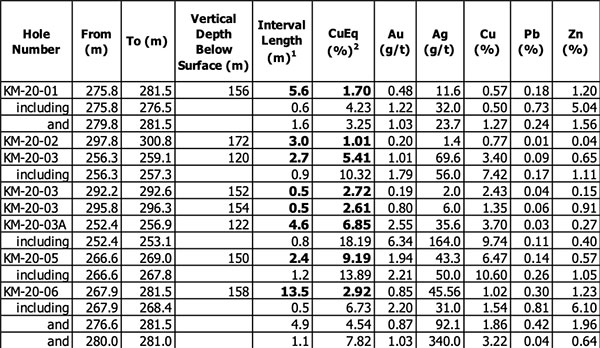

Table 1. Results of Initial Drill Program at Kay Mine North Zone, Yavapai County, Arizona

(1) True widths of the reported mineral intervals have not been determined; additional drilling is required

(2) Assumptions used in USD for the copper equivalent calculation were metal prices of $2.28/lb Copper, $1650/oz Gold, $15/oz Silver, $0.86/lb Zinc, $0.77/lb Pb and recovery is assumed to be 100% as no metallurgical test data is available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 1.06) + (Silver (g/t) x 0.0096) + (Zinc (%) x 0.3772) +(Lead (%) x 0.3377).

Figure 1. Section looking east at the Kay Mine Project, Yavapai County, Arizona

Figure 2. Section looking northeast at the Kay Mine Project, Yavapai County, Arizona

Figure 3. Hole KM-20-03 at depth of 256m downhole, grading 7.4% Cu, 1.8g/t Au, 56g/t Ag, and 1.1% Zn.

This image is of a selected interval and is not representative of mineralization hosted on the property.

Figure 4. Hole KM-20-05 at depth of 267m downhole, grading 10.6% Cu, 2.2g/t Au, 50g/t Ag, and 1.0% Zn.

This image is of a selected interval and is not representative of mineralization hosted on the property.

Dr. Mark Hannington, Technical Advisor to the Board, commented, “The Proterozoic massive sulfide deposits of the Yavapai Supergroup, such as in the Verde mining district, are among the most copper-rich deposits of this type, and historic grades for the Kay Mine (Exxon, 1982) are in the top 25 percent of Cu grades for global VMS deposits based on USGS grade-tonnage models.”

Sugarloaf Peak Project Update

Arizona Metals owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5g/t (Dausinger, 1983, Westworld Resources). The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be compliant with current NI 43-101 standards. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Company has submitted an application for 10,000m drill program at Sugarloaf, comprised of core and RC holes, intended to upgrade the historic resource to a current mineral resource, and also test the strike extensions. Final permit receipt is expected in Q2’2020. The Company also intends to undertake a metallurgical testing program, comprised of bottle-roll and column leach recovery tests.

On March 19th 2020, the Company announced the temporary suspension of the Kay Mine drill program in order to protect the safety of employees, contractors and the local community in response to the COVID-19 pandemic. No cases of infection have been reported in any of the Company’s employees or contractors. Arizona Metals’ employees and contractors will be ready to resume operations as soon as local conditions are deemed safe.

The Company has a strong cash position of approximately $3M, and will now focus efforts on modelling drill data received to date in order to refine planned targets for the resumption of drilling.

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Property in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8g/t gold, 3.03% zinc, and 55g/t silver”. The historic estimate at the Kay Mine was reported by Exxon Minerals in 1982. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 150m to at least 900m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5g/t (Dausinger, 1983, Westworld Resources).

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Qualified Person who reviewed and approved the technical disclosure in this release is David Smith, CPG.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the resumption of drilling and the effects of the COVID-19 pandemic on the business and operations of the Company. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of financing; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

NEITHER THE TSX VENTURE EXCHANGE (NOR ITS REGULATORY SERVICE PROVIDER) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

For further information, please contact:

Marc Pais

President and CEO Arizona Metals Corp.

(416) 565-7689

[email protected]

www.arizonametalscorp.com

https://twitter.com/ArizonaCorp